23 January 2025

No metals no transition

Why investors should not overlook the critical metals value chain, a key enabler of the energy transition

Over 190 countries have endorsed the decarbonization goals set by the Paris Agreement. In this context, the European Union has committed to achieving climate neutrality by 2050, targeting a net-zero balance in greenhouse gas emissions. In addition, sovereignty and energy independence are further heightening the need for transitioning to renewable energy in the current geopolitical landscape.

This energy transition necessitates extensive electrification and the large-scale implementation of clean energy technologies, such as wind turbines, solar panels, energy storage, electric vehicles, and smart grids – all of which require substantial amounts of various critical metals for their production.

In 2023, InfraVia, launched a dedicated strategy to invest globally in critical metals across the entire value chain (extraction, processing, and recycling) through long-term minority investments.

In this interview, Sylvain Eckert, Partner, Critical Metals at InfraVia, discusses the upcoming critical metal supercycle and related investment opportunities within the metal supply chain.

Why does the energy transition require massive investments in critical metals?

Sylvain Eckert: “Let’s consider a few key figures. Generating one megawatt-hour of renewable energy requires up to 13 times more metals than producing the same amount of energy from fossil fuels, and producing an electric vehicle requires up to 6 to 7 times more metals than a conventional internal combustion engine vehicle1. Essentially, the world’s transition to a green economy demands parallel investments in producing the commodities that will enable it. This shift to clean energy will not only lead to a significant increase in the volume of metals consumed but will also broaden the spectrum of metals needed—ranging from lithium, copper, cobalt, and nickel to rare earth elements, among others. This presents a substantial investment opportunity.”

Specifically, what critical metals will play a pivotal role in the electrification and energy transition?

“The European Commission has defined a list of 34 critical raw materials essential for the energy transition. Each material can have different market dynamics. However, long-term demand will ultimately be driven by the development of various clean energy applications.

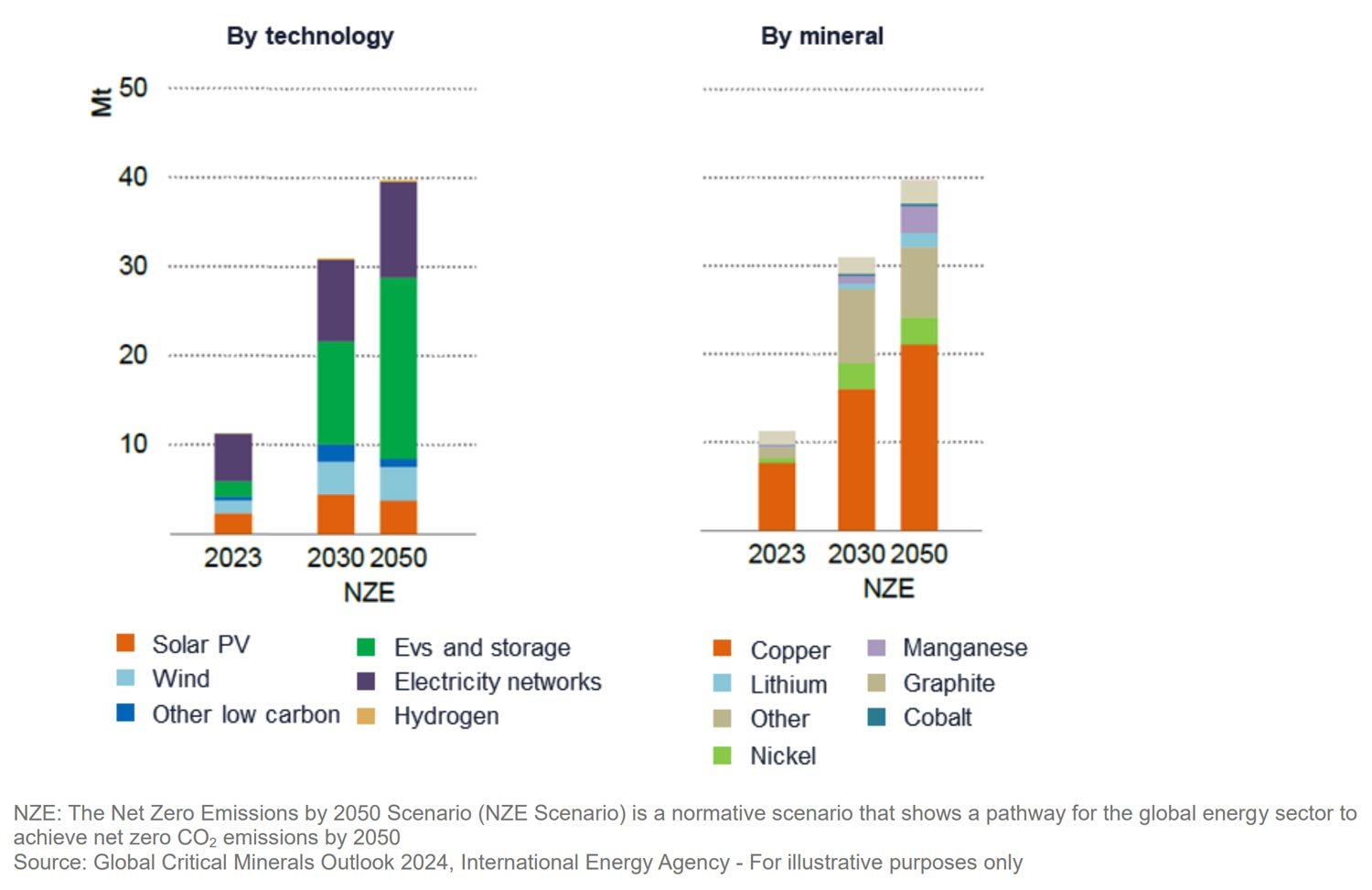

According to the International Energy Agency (IEA), demand for copper, essential in electrification, is projected to increase by more than 50% by 2040 in a net zero emissions (NZE) scenario compared with 2023. Additionally, the demand for nickel, cobalt, and rare earth elements is expected to double. Graphite demand is anticipated to grow fourfold, driven by a significant rise in battery deployment for electric vehicles and grid storage. Lithium demand could see an astonishing increase, projected to rise 8 to 10 times due to its essential role in almost all battery technologies2.”

Is the regulatory environment supportive of this shift toward metals?

“Indeed, developing clean energy technology and large-scale electrification can only succeed if we consider the entire value chain from metal extraction to processing and recycling. China has recognized this by strengthening its presence in mining countries to secure mineral supplies and expanding its domestic refining capabilities, thereby controlling the entire value chain for some of these metals.

Meanwhile, the European Union has made a significant shift in its approach to the metals sector. In April 2024, the European Commission adopted the Critical Raw Materials Act, which aims to ensure European industry access to a secure and sustainable supply of critical raw materials. The CRMA calls for a diversified supply of critical metals and traceability of battery raw materials and sets a regulatory framework for selecting and implementing strategic raw material projects in the EU Member States.

This entails extracting 10% of European needs from European deposits by 2030, refining 40%, and recycling at least 25% of total usage. Additionally, the regulation sets a maximum dependency threshold of 65% on any single third country.

In summary, demand for metal is set to surge driven by the transition to a low-carbon economy, and this growth is underpinned by strong institutional and regulatory support.”

How do you approach this opportunity as a private investor?

“Investing in the critical metals value chain presents a substantial opportunity for private equity.

The capital expenditure required to support the increased capacities for production, refining, and recycling over the coming decade is substantial and is estimated at €125bn3 per annum in order to meet the temperature trajectory objectives. Although a significant portion of this capital is expected to come from traditional sources – such as investments by major mining companies and public equity markets – we believe a significant funding gap will remain, creating ample opportunities for private equity players. It is important to note that, first, traditional players tend to focus primarily on mainstream commodities like iron ore, copper, and gold, with only a relatively recent shift (for some of them) toward other metals like lithium. Second, there is not enough capacity to fund all the upcoming projects – while most critical metals remain relatively small markets compared to the steel, copper, gold, or aluminum value chains, there is a window of opportunity to invest in medium-sized, less capitalintensive opportunities in those fast-growing markets.

We are currently seeing numerous investment opportunities in Europe and other OECD countries throughout the entire value chain (extraction, processing, refining, recycling) and for a very wide variety of critical metals.”

“The development of clean energy technologies and large-scale electrification cannot happen without massive amounts of various critical metals.”

What specific skills are required as an investor in this area?

“Currently, only a small number of private capital players are actively involved in the critical metals value chain. Engaging in this field requires specialized knowledge in several areas.

For example, on the due diligence and execution side, deep technical and industrial knowledge is required to gain a comprehensive understanding of all aspects of the investment opportunity and identify key success factors. This includes geological, mining, metallurgical, and processing expertise, as well as specialized financing and sector-specific ESG skills.

To address these challenges, we have assembled a dedicated investment team with a diverse background, comprising professionals with vast experience in the metals and mining sector across various jurisdictions and metals. Our team possesses in-depth industry expertise, an extensive international network (that includes metals and mining corporations, developers, other investors, and public authorities), and strong structuring and financing capabilities relevant to the industry. We believe that the combination of industry knowledge, technical skills, financing experience, and execution capability is key to success. It enables a comprehensive analysis of investments from every angle and ensures the right level of selectivity.

Additionally, we view this strategy with a longer-term investment horizon compared to other players in the market. This approach is particularly suited for institutional investors and enables us to navigate short-term volatility while remaining aligned with the significant growth potential tied to the ongoing energy transition.”

What are the value-creation drivers when investing in these types of assets?

“Depending on where you invest in the value chain (extracting, processing, recycling), there are several key drivers of value creation through active asset management.

For example, value can be generated by transitioning from greenfield to fully operational assets via robust contractual frameworks and strategic support. Another key route can be growing platforms via vertical integration and/or horizontal replication. Operational improvements are another key lever that can be obtained through expertise in various dimensions, including exploration, minelife expansions, cost optimization, and ESG initiatives. Financing tailored to specific project needs can also enhance overall value and returns. Additionally, structuring offtakes (i.e., securing the distribution of production) can protect against metal price volatility and provide additional traceability to the end-users. Supporting companies on the value-creation journey and having credibility to bring them value as well as challenge them requires deep knowledge of the industry.”

“Investing in the critical metals value chain presents a substantial opportunity for private equity.”

As this is quite a strategic initiative, what is the relationship between public and industrial players?

“First and foremost, we view this as an attractive private investment opportunity driven by strong and fastgrowing demand. In addition, we have launched this strategy with the support of the French State, looking to accelerate sustainable and traceable supply chains for industries requiring critical metals.

Our strategy will contribute to developing upstream supply globally, re-onshoring refining and processing, and embed circularity. We believe it is essential to build partnerships with industrial players, given their increasing need in this space. Similar to our infrastructure investments, we can support the public and private sector by providing additional financing capability and the adequate skillset to execute and manage those investments.

Furthermore, we believe it is crucial to take an active role in the governance of investments and to secure offtakes, which means ensuring access to production outputs for industries across sectors (renewable energy, automotive, and strategic industries). And, last but by no means least, an active role can help ensure strong and responsible ESG (Environment, Social, and Governance) standards are applied, leading to a more sustainable supply chain and increased traceability.”

Talking about ESG, what is the environmental impact of this shift towards using more metals?

“There are many misconceptions surrounding the metal and mining industry. One common belief is that the energy transition will lead to even more mining activity. However, according to the Breakthrough Institute report4, metal extraction for solar photovoltaic (PV) systems, onshore wind, or batteries involves a much lower mining intensity, meaning it requires less material to be extracted than coal mining, which is effectively being substituted.

Another misconception is that metal mining exerts a higher environmental pressure relative to other industries. However, when you actually look at it in detail, the annual water consumption for metal & mining is less than half that of current coal mining5, even when considering the anticipated future demand for materials needed for energy transition. Additionally, it is important to mention deforestations where metal mining actually has a marginal impact compared to agriculture and livestock production for instance6.”

How do you implement an ESG framework that works in this type of investment?

“Mining is not a choice. How we mine, refine and recycle is. The metal and mining industry has developed recognized operational standards that we can build on to support a proprietary robust ESG framework. They involve a broad range of sophisticated environmental, social, and governance criteria adapted to geographies and types of projects. Governance rules and practices should be applied to all projects, with increased scrutiny based on the specific countries involved.

Managing carbon emissions is crucial from an environmental standpoint because they are directly connected to the energy transition. While the carbon footprint associated with critical metals in the mining sector is relatively low, it becomes more significant during the processing stages, albeit remaining small compared to the footprint of aluminum and steel, for example. Key environmental priorities should also include effective waste management, protecting biodiversity around extraction sites, and controlling water consumption. Further, it is key to note that rehabilitation of the local environment is a requisite of any mining investment, not a nice to have.

The social aspect is equally important. Beyond addressing the ‘not in my backyard’ phenomenon, it is vital to ensure that projects deliver tangible benefits to local communities. Gaining social acceptability for these projects is essential and can be done through thorough consultations and education about the costs and benefits for the community. More widely, in a context where end customers demand transparency, the need for traceability is more critical than ever to ensure the Environmental, Social, and Governance excellence of supply chains.

For investors looking to support and participate in the energy transition, critical metals provide a huge investment opportunity for private capital. Similar to when InfraVia started investing in a nascent infrastructure sector 16 years ago, we believe that the critical metals sector will become an asset class in its own right.”

ILLUSTRATION: Mineral requirement for clean energy technologies in the NZE scenario

References

- Energy Transitions Commission, “Material and Resource Requirements for the Energy Transition,” 2023

- IEA – Global Critical Minerals Outlook 2024

- Annual reports, TSX / TSX ventures, Australian Stock Exchange, WoodMac “The Energy Transition Starts and Ends With Metals – Nov 2022

- Breakthrough Institute Report: Updated mining footprints and raw material needs for clean energy

- ETC “Material and Resource Requirements for the Energy Transition” – 2023

- WWF Extracted Forest report – 2023

Sylvain Eckert, Partner,

InfraVia, Critical Metals

Sylvain has more than 20 years of experience in the metals and mining industry, with in-depth industry expertise and extensive international network.